Preliminary seniority list ofUnskilled Workers as on 01/04/2013

Click Here

Tuesday 29 October 2013

Kerala State Right to Service Act-2012 -KWA

Kerala State Right to Service Act-2012 -KWA

Click Here

Final Seniority list of LDC/UDT

Final Seniority list of LDC/UDT Qualified for promotion/conversion as Upper Division Clerk

Circular

Thursday 17 October 2013

Wednesday 16 October 2013

What is Dies non ?

Dies non – No Work No Pay

All the Central Government employees

those who are participated in the Two Day Strike have been warned by the

government through its circular dated 15-02-2013, that leave of any

kind will not be sanctioned for them. It is under stood that the absence

of two days in strike period will be treated as Dies non

The West Bengal State Government too

issued a circular a day before , in which it has been said that no leave

will be granted to its employees during the strike, and if they aren’t

present in office it will be treated as dies non with

no salary admissible if they don’t give a suitable reason and produce

proper documents for refraining from turning up for duty.

What is Dies non ?

Dies non: In service terms, “dies non”

means a day, which cannot be treated as duty for any purpose. It does

not constitute break in service. But the period treated as ‘dies non’

does not qualify as service for pensionary benefits or increment.

As per the Postal Manual Volume III,

Central Civil Services (Classification,Control and appeal) rules, 1965,

the Absence of officials from duty without proper permission or when on

duty in office, they have left the office without proper permission or

while in the office, they refused to perform the duties assigned to them

is subversive of discipline. In cases of such absence from work, the

leave sanctioning authority may order that the days on which work is not

performed be treated as dies non, i.e. they will

neither count as service nor be construed as break in service. This will

be without prejudice to any other action that the competent authorities

might take against the persons resorting to such practices.

Tuesday 15 October 2013

Aadhaar status on SMS

Aadhaar is a 12-digit individual identification

number issued by the Unique Identification Authority of India on behalf

of the Government of India.This number will serve as a proof of

identity, anywhere in India. Any individual, irrespective of age and

gender, who is a resident in India and satisfies the verification

process laid down by the UIDAI can enrol for Aadhaar.

Aadhaar status on SMS

1. Send SMS as "UID STATUS <14 digit Enrolment

number>" to 51969 ex. "UID STATUS 12345678901234" to know the status

of your Aadhaar enrolment. If you send this SMS from your registered

mobile number then you will get back your Aadhaar number, if generated.

2. Send SMS as "UID GETUID <14 digit Enrolment number>" to 51969 to know your Aadhaar number from your registered mobile number.

Please note that if you are prompted to enter 28 digit EID then send SMS as "UID STATUS or GETUID <28 digit EID as 14 digit Enr No +ddmmyyyyhhmmss>"

2. Send SMS as "UID GETUID <14 digit Enrolment number>" to 51969 to know your Aadhaar number from your registered mobile number.

Please note that if you are prompted to enter 28 digit EID then send SMS as "UID STATUS or GETUID <28 digit EID as 14 digit Enr No +ddmmyyyyhhmmss>"

FORM TO BE SUBMITTED BY NEWLY (FRESH) APPOINTED EMPLOYEES IN KERALA GOVT SERVICE

http://keralapwd.gov.in/keralapwd/eknowledge/Upload/documents/1142.pdf

(POLICE VERIFICATION FORM

http://keralapwd.gov.in/keralapwd/eknowledge/Upload/documents/1146.pdf

(MEDICAL CERTIFICATE)

http://keralapwd.gov.in/keralapwd/eknowledge/Upload/documents/1144.pdf

(JOINING REPORT FORM SPARK FORM NO:1)

(POLICE VERIFICATION FORM

http://keralapwd.gov.in/keralapwd/eknowledge/Upload/documents/1146.pdf

(MEDICAL CERTIFICATE)

http://keralapwd.gov.in/keralapwd/eknowledge/Upload/documents/1144.pdf

(JOINING REPORT FORM SPARK FORM NO:1)

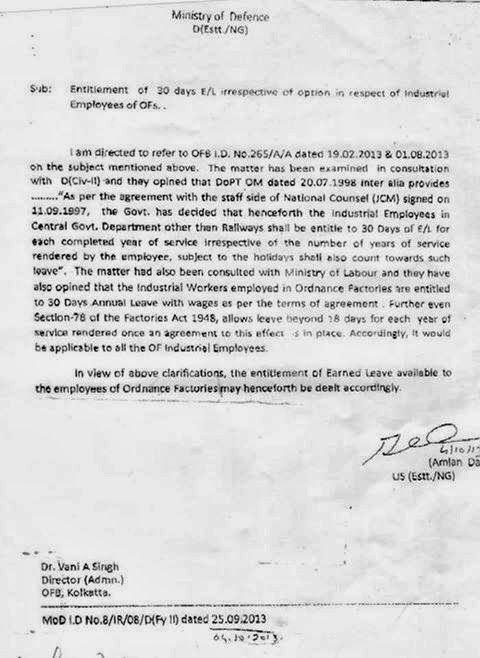

30 Days Earned Leave for Industrial Employees of OFB

30 Days Earned Leave for Industrial Employees of OFB

Minstry of Defence

D(Estt/NG)

D(Estt/NG)

MoD.I.D.No8/IR/08/D(FyII) dated 25.09.2013

Sub : Entitlement of 30days EL irrespective of option in respect of Industrial Emploees of OFs

I am directed to refer to OFB I.D >No

265/A/A dated 19.02.2013 and 01.08.2013 on the subject mentioned above.

The matter has been examined in consultation with D(Civ-II) and they

opined that DopT OM dated 20.07.1998 inter alia provides ….”As per the

agreement with the staff side of National Counsel (JCM) signed on

11.09.1997,the govt. has decided that henceforth the Industrial

Employees in Central Government Department other than Railways shall be

entitled to 30 Days EL for each completed year of service irrespective

of the number of years of service rendered by the employee, subject to

the holidays shall also count towards such Leave”. The matter had also

been consulted with Ministry of Labour and they have also opined that

the Industrial workers employed in Ordnance Factories are entitled to 30

days Annual Leave with wages as per the terms of agreement. Further

even Section -78 of the Factories Act 1948 allows leave beyond 18 days

for each year of service rendered once an agreement to this effect is in

place. Accordingly , it would be applicable to all the OF Industrial

Employees

In view of above clarifications the

entitlement of Earned Leave available to the employees of Ordnance

Factories may henceforth be dealt accordingly

MoD order is given below

source : indwf.blogspot.comVisiontek 21G (Improoved New Model-2013) FWP- ANY GSM SIM Based Land Phone. A MOBILE in the Shape of LANDLINE. BEST FOR OFFICE AND HOMES

Visiontek 21G (Improoved New Model-2013) FWP- ANY GSM SIM Based Land Phone. A MOBILE in the Shape of LANDLINE. BEST FOR OFFICE AND HOMES

|

|

)

|

New 2013 series Model of Visiontek Multi SIM Wireless 21G GSM Phone, Caller ID With Speaker Phone

Features And Specifications

Highlights Desktop Speaker with superior voice quality

Built in echo-canceller

Short Messages Services (SMS) & Internet

Redial last number or from list

Call Duration, Day, Date & Time Display

Network selection Automatic & Manual

Programmable local area code

Call barring (Local, STD & ISD)

Buzzer indication on call disconnection

Built-in Alarm function

Built-in calculator

Call Log details

250 numbers phone book memory

Fixed and on-hook dialling

LED Indication: Power, Network

Polyphonic/Mono Ring tones

PSTN dial tone

Caller ID

SpecificationsNetwork Frequency

Dual Band GSM 900/1800 MHz

Receiver Sensitivity - 107dB

LCD ScreenDimension: 128 x 64

Number of Lines: 4

Number of Characters per line: 21

Keypad

22 keys for multi-functional operation

Input Voltage Power

AC 100-300V (50Hz to 60Hz) DC output (i) Battery : 13.8V DC output (ii) Load : 9.5V , 1A

Features And Specifications

Highlights Desktop Speaker with superior voice quality

Built in echo-canceller

Short Messages Services (SMS) & Internet

Redial last number or from list

Call Duration, Day, Date & Time Display

Network selection Automatic & Manual

Programmable local area code

Call barring (Local, STD & ISD)

Buzzer indication on call disconnection

Built-in Alarm function

Built-in calculator

Call Log details

250 numbers phone book memory

Fixed and on-hook dialling

LED Indication: Power, Network

Polyphonic/Mono Ring tones

PSTN dial tone

Caller ID

SpecificationsNetwork Frequency

Dual Band GSM 900/1800 MHz

Receiver Sensitivity - 107dB

LCD ScreenDimension: 128 x 64

Number of Lines: 4

Number of Characters per line: 21

Keypad

22 keys for multi-functional operation

Input Voltage Power

AC 100-300V (50Hz to 60Hz) DC output (i) Battery : 13.8V DC output (ii) Load : 9.5V , 1A

Key Feature

Visiontek

General Features

Cordless Phone

1 Line

Audio Features

Yes

Electronic Volume control

Call Features

10 Speed Dialing Buttons

Paging, Any Key Answer

Menu Features

Caller ID Support

Menu with Navigation Keys

Keypad Features

Alphanumerical

Memory Featues

Yes

Yes

160 Logs

Power Features

Battery

Base Unit AC Adapter

10 hrs

6 Days

Additional Features

Yes

Warranty Details

Manufacturer Warranty

1 Year

Is raising retirement age of Central Government Employees a threat for employment prospects of youth?

Is raising retirement age of Central Government Employee a threat for employment prospects of youth?

At the end of Every Year people used to

talk about the proposal of raising the retirement age of government

servants. Normally the people who are at the verge of retirement from

government service are eagerly expecting the government to increase the

retirement age. The Government servants especially those who are in the

pay structure of Pay band –I will have to face financial burden as the

Pension amount they will be paid after commutation will be very meager

and it is not sufficient enough to meet their expenses of day to day

life. Because the Government employees those who are drawing grade pay

of Rs.1800/-, 1900/-, 2000/-, 2400/-and 2800/- will get only around

Rs.20000 as the gross salary of every month. It is understood that one

cannot lead a financially successful life with this income alone. So

many government servants, to run the life, forced to avail loans from

where ever they can get. At the end, they are badly in debt at the time

of retirement. That is why the government servants don’t feel happy

about retiring from service. But extending the service of two years from

60 to 62 will not solve all their problems. It will help them to put

off facing the financial crisis for at least two years. But the

Government does not consider this aspect any way to increase the

retirement age of central government employees from 60 to 62.

Extension of Service to Bureaucrats

The Central Government always wanted

to make better use of the knowledge and experience of its Bureaucrats

even after their retirement. In other words Government wants to secure

their top brass preferably IAS officers by giving service extension.

Sometime extending their service for further period of two year is

difficult task for the concerned department. Extension in service can be

given only in “exceptional circumstances”. For example recently home

Ministry wanted to give one year extension to its former

Director-General of the Central Reserve Police Force (CRPF) as he has

done commendable work in his stint . But it was denied by the

Appointments Committee of the Cabinet (ACC). However, it was mainly the

service rules that led to the ACC declining Home Ministry’s proposal.

Normally IAS officers offered multiple service extension.

The Retirement Age of Professors

The Central Government has

already increased the retirement age of professors in all the central

universities from 62 to 65 years, two years back. Before that, the

retirement age of professors of Central Universities was 62 with the

provision for re-employment for three years after the superannuation.

That time there was some allegation that this provision of re-employment

was being “misused” by the authorities who took such decisions in an

“arbitrary” manner. So Central Government decided to increase the

retirement age of Professors to 65 uniformly.

One year extension for state government employees

Recently the Punjab

government’s decided to offer an extension of one year in service to its

retiring employees with effect from October 2012 . The condition laid

down for this offer was 1.Employees will be given an option to continue

at the same salary.2. They will get no increments in salary during the

extension period but will get any due promotions. The decision to give

the extension was taken to meet the shortage of 35,000 employees who are

expected to retire in next one year. Since, the move may affect

employment prospects of the youth, the government increased the maximum

age limit for recruitment into government service from 37 to 38 years.

The Retirement Age of Judges

On August 18, 2012, The Prime

Minister Dr. Manmohan Singh, speaking at the 150th year celebrations of

the Bombay High Court, said the government was in favour of raising the

age of retirement of High Court judges. Presently, Supreme Court judges

retire at 65 and High Court judges at 62.

Re engagement of Retired Employees in Railways

Whether it is true or not but

it is believed that Railway gave its consensus to raise the retirement

age of its employees, as it is already re-engaging their retired

employee for daily remuneration after their retirement till the age of

62. It was followed from 1998 with the reference of Railway Board Letter

No.E(NG)II/97/RC-4/8 dated 03.02.98. In 2009 the rates of Daily

Allowances also revised for engagement of retired employees on daily

remuneration basis.

So keeping in view of the

entire above aspects one can assume that the state and central

governments and some Departments are in fovour of increasing the

retirement age of Central and State government employees.

But Social Activists and youth

associations are against this proposal and they expressed their

dissatisfaction over this and telling that the retirement age of

central government employees should not be increased to 62 as increasing

the retirement age is a threat for employment prospects of the

youth.Many of them opined that instead of increasing, the retirement age

should be reduced to 58 so that the youngsters will be given

opportunity to get into Central government services.

Read Latest News : Central Government Employees Retirement Age 60 to 62 years Latest News

Central Government Employees Retirement Age 60 to 62 years Latest News

An in-principle decision has been taken to increase the retirement age by two years within this year itself’ : Sources

The proposal of increasing retirement

age of central government employees from 60 to 62 is now the hottest

issue to talk about. According to the sources, the central government is

serious about increasing retirement age for various reasons. The

leaders of Defence and Railway workers federations hinted about the

possibility of increasing retirement age of central government

employees, as the manpower sanction in railway and defence is very less

than comparing to the retirement of its employees. There is a huge gap

between recruitment and retirement. The resultant vacancies due to

retirement and death left unfilled. So the departments find it hard to

achieve their target in time without sufficient manpower. So the

decision of increasing retirement age of central government employees

from 60 to 62 seems inevitable at this juncture. The financial express

also posted an article in this regard in its website www.financial

express.com.

The government is planning to extend the

retirement age of all central government employees by two years — from

the current 60 to 62 years. Sources said that an in-principle decision

has been taken in this regard and the department of personnel and

training (DoPT) has begun the work to implement the same. A formal

announcement to this effect is expected this year itself.

The last time the government extended

the retirement age of central government employees was in 1998. It was

also a two-year extension from 58. This was preceded by the

implementation of the 5th Pay Commission, which had put severe strain on

government’s finances. Subsequently, all state governments followed the

Centre’s policy by extending the retirement age by two years. Public

sector undertakings followed suit too.

The decision to extend the retirement age is well-timed both politically and economically.

The UPA government reckons the move

would be a masterstroke. At a time when it is buffeted by several

corruption cases, it is felt that the extension of the retirement age

will go down well with the middle classes. Economically also, the move

makes sense because by deferring payment of lump sum retirement benefits

for a large number of employees by two years, the government would be

able to manage its finances better.

“An in-principle decision has been taken

to increase the retirement age by two years within this year itself.

This would reduce the burden on the fisc from one-time payment of

retirement benefits for employees including defence and railways

personnel,” an official involved in the discussion said. With the fiscal

consolidation high on the government’s agenda, this deferment would

come handy.

There’s some flip side too if the

retirement age is extended by two years. Those officials empanelled as

secretaries and joint secretaries would have to wait longer to actually

get the posts. And of course, there is the issue of average age profile

of the civil servants being turning north.

It is also felt that any extension is not being fair with a bulk of people who still look for jobs in the government.

However, officials point out that at

least it prevents an influential section of the bureaucracy to hanker

for post-retirement jobs with the government like chairmanship of

regulatory bodies or tribunals.

“As it is, a sizeable section of senior

civil servants work for three to five years after the retirement in some

capacity or the other in the government,” said a senior government

official. The retirement age of college teachers and judges are also

beyond 60.

As per a study, the future pension outgo

for the existing Central and State government employees is estimated at

a staggering R1,735,527 crore or 55.88% of GDP at market prices of

2004-05.

with the inputs from : www.financialexpress.com

Sunday 13 October 2013

Productivity Linked Bonus for Postal Staffs for the Year 2012-2013

Productivity Linked Bonus for Postal Staffs for the Year 2012-2013

File No. 26-04/2013-PAP

Government of India

Ministry of Communications & IT

Department of Posts

(Establishment Division)

Dak Bhawan,Sansad Marg,

New Delhi-110 001

Government of India

Ministry of Communications & IT

Department of Posts

(Establishment Division)

Dak Bhawan,Sansad Marg,

New Delhi-110 001

Dated 4 th October, 2013

Subject:- Productivity Linked Bonus for the Accounting year 2012-2013.

Sir/Madam,

I am directed to convey the approval of

the President of India for payment of Productivity Linked Bonus for the

accounting year 2012-2013 equivalent of emoluments of 60 (Sixty) days to

the employees of Department of Posts in Group `D`,Group `C` and non

Gazetted Group `B`. Ex-gratia payment of Bonus to Gramin Dak Sevaks who

are regularly appointed after observing allappointment formalities and

adhoc payment of Bonus to Casual labourers who have been conferred

Temporary Status are also to be paid equivalent to allowance/wages

respectively for 60 (sixty) Days for the same period.

1.1 The calculation for the purpose of payment of Bonus under each category will be done as indicated below.

2. REGULAR EMPLOYEES:

2.1 Bonus will be calculated on the basis of the following formula:-

Average emoluments X Number of days of Bonus

———————————————-

30.4(Average no. of days in a month)

———————————————-

30.4(Average no. of days in a month)

2.2 The term “Emoluments” for regular

Employees include basic Pay in the pay Band plus Grade Pay, Dearness

Pay, Personal Pay, Special Pay (Allowances), S.B.Allowance, Deputation

(Duty ) Allowance, Dearness Allowance and Training Allowance given to

Faculty Members in Training Institutes. In case of drawl of salary

exceeding Rs.3500/- (Rs. Three Thousand Five hundred only)in any month

during the accounting year 2012-13 the Emoluments shall be restricted to

Rs.3500/- (Rs. Three Thousand Five hundred only) per month only.

2.3 “ Average Emoluments” for regular

Employees is arrived at by dividing by twelve ,the total salary drawn

during the year 2012-13 for the period from 1.4.2012 to 31.3.2013, by

restricting each month’s salary to Rs.3500/- (Rs. Three Thousand Five

hundred only) per month. However, for the periods of EOL and dies-non in

a given month ,proportionate deduction is required to be made from the

ceiling limit of Rs.3500/- (Rs. Three Thousand Five hundred only).

2.4 In case of those regular employees

who were under suspension, or on whom dies-non was imposed ,or both,

during the accounting year, the clarificatory order issued vide Paras 1

& 3 respectively of this office order No. 26-8/80-PAP (Pt-I) dated

11.6.81 and No. 26-4/87-PAP (Pt.II) dated 8.2.88 will apply.

2.5 Those employees who resigned,

retired, left service or proceeded on deputation within the Department

of Posts or those who have proceeded on deputation outside theDepartment

of Posts on or after 1.4.2012 will also be entitled to Bonus. In case

of all suchemployees, the Bonus admissible will be as per provisions of

Para 2.1 to 2.3 above.

3. GRAMIN DAK SEVAKS (GDS)

3.1 In respect of Gramin Dak Sevaks who

were on duty through out the year during 2012-2013, Average monthly Time

Related Continuity Allowance will be calculated taking into account the

Time Related Continuity Allowance (TRCA) plus corresponding Dearness

Allowance drawn by them for the period from 1.4.2012 to 31.3.2013

divided by 12 (Twelve). However, where the Time Related Continuity

Allowance exceeds Rs 3500/- (Rs.Three Thousand Five hundred only) in any

month during this period., the allowances will be restricted to Rs

3500/- (Rs.Three Thousand Five hundred only) per month. Ex-gratia

payment of Bonus may be calculated by applying the Bonus formula as

mentioned below:-

Average TRCA X Number of days of Bonus

———————————————-

30.4 (Average no. of days in a month)

———————————————-

30.4 (Average no. of days in a month)

3.2 The allowances drawn by a substitute

will not be counted towards Bonus calculation for either the substitute

or the incumbent Gramin Dak Sevaks. In respect of those Gramin Dak

Sevaks who were appointed in short term vacancies in Postman/Group `D`

Cadre, the clarificatory orders issued vide Directorate letter No.

26-6/89-PAP dated 6.2.1990 and No. 26-7/90-PAP dated 4.7.91 will apply.

3.3 If a Gramin Dak Sevak has been on

duty for a part of the year by way of a freshappointment, or for having

been put off duty, or for having left service, he will be paid

proportionate ex-gratia Bonus calculated by applying the procedure

prescribed in Para 3.1

3.4 Those Gramin Dak Sevaks who have

resigned, discharged or left service on or after 1.4.2012 will also be

entitled to proportionate ex-gratia Bonus. In case of all such Gramin

Dak Sevaks, the Ex-gratia Bonus admissible will be as per provisions of

Para 3.1 above.

3.5 In case of those Gramin Dak Sevaks

who were under put off duty or on whom dies non was imposed, or both

during the accounting year ,the clarificatory orders issued vide Para 1

& 3 respectively of this office order No. 26-8/80-PAP (Pt I) dated

11.6.81 and No. 26-4/87-PAP (Pt II) will apply.

4. FULL TIME CASUAL LABOURERS INCLUDING TEMPORARY STATUS CASUAL LABOURERS)

Full Time Casual Labourers (including Temporary Status Casual Labourers ) who worked for 8 hours a day, for at least 240 days in a year for three consecutive years or more (206 days in each year for three years or more in case of offices observing 5 days a week) as on 31.3.2013 will be paid ad-hoc Bonus on notional monthly wages of Rs.1200/- (Rupees Twelve Hundred only)

Full Time Casual Labourers (including Temporary Status Casual Labourers ) who worked for 8 hours a day, for at least 240 days in a year for three consecutive years or more (206 days in each year for three years or more in case of offices observing 5 days a week) as on 31.3.2013 will be paid ad-hoc Bonus on notional monthly wages of Rs.1200/- (Rupees Twelve Hundred only)

The maximum ad-hoc Bonus will be calculated as below:-

(Notional monthly wages of Rs.1200) X (Number of days of Bonus)

——————————————————————–

30.4 (average no. of days in a month)

——————————————————————–

30.4 (average no. of days in a month)

Accordingly , the rate of Bonus per day will work out as indicated below:-

Maximum ad-hoc Bonus for the year

—————————————

365

—————————————

365

The above rate of Bonus per day may be

applied to the number of days for which the services of such casual

labourers had been utilized during the period from 1.4.2012 to

31.3.2013. In case where the actual wages in any month fall below during

the period 1.4.2012 to 31.3.2013 the actual monthly wages drawn should

be taken into account to arrive at the actual ad-hoc Bonus due in such

cases.

5. The amount of Bonus /Ex gratia

payment /Adhoc Bonus payable under this order will be rounded to the

nearest rupee. The payment of Productivity Linked Bonus as well as the

ex-gratiapayment and ad-hoc payment will be chargeable to the Head

`Salaries` under the relevant Sub –Head of account to which the pay and

allowances of the staff are debited. The payment will be met from the

sanctioned grant for the year 2013-2014.

6. After payment, the total expenditure

incurred and the number of employees paid may be ascertained from all

units by Circles and consolidated figures be intimated to the Budget

Section of the Department of Posts. The Budget Section will furnish

consolidated information to PAP Section about the total amount of Bonus

paid and the total number of employees(category-wise) to whom it was

distributed for the Department as a whole.

7. This issue with the concurrence of Integrated Finance Wing vide their diary No. 156/FA/13/CS dated .4th October, 2013

8. Receipt of this letter may be acknowledged

sd/-

(SHANKAR PRASAD)

Assistant Director General (Estt)

(SHANKAR PRASAD)

Assistant Director General (Estt)

Thursday 10 October 2013

Expected DA from January 2014

Expected DA from January 2014

The rate of Dearness Allowance payable

to central Government Employees is arrived from a prescribed formula. In

which the main component is the Average AICPIN for Industrial Workers

for twelve months prior to every January and July of every year. So it

is quite obvious that everyone wants to know the Consumer Price Index

Numbers for Industrial Workers of every month. So they can calculate the

rate of Dearness Allowance approximately after every six months.

The AICPIN for Industrial workers for

the month of July has been released by Labour Bureau to day. As this is

the seventh month’s AICPIN , we need still five months AICPIN to

calculate the rate of Dearness Allowance to be paid to central

Government Employees from January 2014. But with these 7 months CPI

points, the expected DA from January 2014 can be arrived approximately.

If we look at the increase rate of the

AICPIN for the 12 months starting from January 2012 to December 2012,

the AICPIN for the month of January 2012 was 198 and for the month of

December 2012 was 219. The total increase for the year was 21 points.

For the next twelve months starting from

July 2012 to June 2013, the AICPIN for July 2012 was 212 and June 2013

was 231 and the total increase was 19 points.

So we can expect that for these twelve

months from January 2013 to December 2013 the increase will be more than

20 points. It should be noticed that the AICPIN is increased by 4

points for the month of July 2013. This trend is expected to be

continued as the Rupee is falling against Dollar consistently. It will

have a considerable impact on the prices of basket of essential

commodities and Consumer Price Index too. The month of January has been

started with 221 points, and this July 2013 touched 235 points level. Up

to this month the total increase is 14 points. As this is the seventh

month of these twelve months, the remaining 5 months will have a

increase of 10 to 15 points level. So the total increase for this year

will be of 24 to 29 points. According to this summary the Average AICPIN

for these twelve months will be from 233 points to 234 points.

Taking all the above factors into

consideration, if we apply this in the formula prescribed for

calculating the rate of Dearness Allowance, the answer is as follows:

The Expected DA from January 2014 will be at 100% to 102% level.

Wednesday 9 October 2013

7TH PAY COMMISSION FOR CENTRAL GOVT EMPLOYEES

7th Pay Commission Projected Pay Scale

The 7th pay commission projected pay

scale is worked out based on the comparative rise in the pay scales

from 1st pay commission to 6th Pay commission.

Being a government servant one can

witness a considerable pay hike at least twice or thrice of his/her

entire service period. Because, other than promotion, only the pay

commission recommendation will give them considerable pay hike. But it

takes place once in ten years. Now a days a government employee can

render service 20 or 30 years only due to non availability of employment

opportunity in government service below the age of 25. So there is no

need to be get annoyed by hearing the voice for seventh pay commission

from central government employees. Because constituting next pay

commission is for nothing but to review the salary of the govt. servants

with the current economical condition of the country.

How the pay of a govt. employee had been fixed at the beginning of the Independence India.

Till now there are six pay commission

had been constituted to review and recommend pay structure of central

government employees.

All the six pay commissions have taken many aspects into consideration to prescribe the pay structure for government servants.

In the first pay commission the concept of ‘living wage’ was adopted.

In second pay commission it had been

reiterated that the pay structure and working condition to be crafted in

a way so as to ensure the effective functioning of government

mechanism.

The third pay commission adopted the concept of ‘need based wage’

The Fourth CPC had recommended the

government to constitute permanent machinery to undertake periodical

review of pay and allowances of Central Government employees, but which

got never implemented.

In Fifth pay commission all federations

demanded that the pay scale should be at par with the public sector. But

the pay commission didn’t accept this and told that the demand for

parity with the Public Sector was however difficult to concede as it

felt that the Job content and condition of service in the government and

pulic sector not necessarily the same. There were essential differences

between the two sectors.

The Sixth Central Pay Commission,

claimed that it had not only tried to evolve a proper pay package for

the Government employees but also to make recommendations rationalizing

the governmental structure with a view to improve the delivery

mechanisms for providing better services to the common man

What about seventh pay commission?

Generally every pay commission, before

recommending a pay structure, it used to analyze all the aspects

including the economic situation of the country, financial resources of

the government, comparison with the public sector, private sector and

state government pay structure etc. So it is very much clear that Pay

Determination is very complicated and sensitive task. Without any doubt

every one accepts that this is very challenging task too. In order to

determine the new pay structure the pay commission has to go through

voluminous data consisting current economic condition, strength of the

work force and working condition etc. In the meantime, if one tries to

suggest or comment about 7thy pay commission pay scale or about what the

seventh pay commission pay scale would be, it will not get much

importance.

But when we come across all the

recommendations of six pay commissions, we observed an interesting

factor which is common to all the pay commission recommendations,

particularly in the matter of percentage of increase in the pay. Average

3 times increase in the pay was recommended by each pay commission and

it was accepted by government and implemented. We have posted three

articles about six pay commissions before this post.

Click the link given below to see those articles and average increase was worked out in the table.

First CPC to Third CPC Pay Scales

Fourth CPC pay scale and Fifth Pay commission

Short Description about Sixth Pay Commission

Obviously it is simple thing, we can say

it a mathematical coincidence that we have in common in all previous

pay commission, but we cannot neglect this. Because it was there, every

time it is noticed that the revised pay was approximately three times

higher than its pre revised pay. Apart from all the factors which has

been used to determine the pay revision, we can use this simple formula

‘common multiplying factor’ to know the 7th pay commission pay scale .

If next pay commission prefer to continue the same running pay band and

grade pay system for seventh pay commission also, the pay structure may

be like the following projected figures given below, using common

multiplying factor ‘3’. The Following is only the projected figure using

common multiplying factor ‘3’

7th Pay Commission Projected Pay Scale

SIXTH CPC PAY STRUCTURE

|

PROJECTED PAY STRUCTURE AFTER 7th PAY COMMISSION

|

|||||

Name of Pay Band/ Scale

|

Corresponding Pay Bands

|

Corresponding Grade Pay

|

Entry Grade +band pay

|

Projected entry level pay using uniform multiplying factor` 3’

|

||

Band Pay

|

Grade Pay |

Entry Pay

|

||||

PB-1

|

5200-20200

|

1800

|

7000

|

15600-60600

|

5400

|

21000

|

PB-1

|

5200-20200

|

1900

|

7730

|

15600-60600

|

5700

|

23190

|

PB-1

|

5200-20200

|

2000

|

8460

|

15600-60600

|

6000

|

25380

|

PB-1

|

5200-20200

|

2400

|

9910

|

15600-60600

|

7200

|

29730

|

PB-1

|

5200-20200

|

2800

|

11360

|

15600-60600

|

8400

|

34080

|

PB-2

|

9300-34800

|

4200

|

13500

|

29900-104400

|

12600

|

40500

|

PB-2

|

9300-34800

|

4600

|

17140

|

29900-104400

|

13800

|

51420

|

PB-2

|

9300-34800

|

4800

|

18150

|

29900-104400

|

14400

|

54450

|

PB-3

|

15600-39100

|

5400

|

21000

|

29900-104400

|

16200

|

63000

|

PB-3

|

15600-39100

|

6600

|

25530

|

46800-117300

|

19800

|

76590

|

PB-3

|

15600-39100

|

7600

|

29500

|

46800-117300

|

22800

|

88500

|

PB-4

|

37400-67000

|

8700

|

46100

|

112200-20100

|

26100

|

138300

|

PB-4

|

37400-67000

|

8900

|

49100

|

112200-20100

|

26700

|

147300

|

PB-4

|

37400-67000

|

10000

|

53000

|

112200-20100

|

30000

|

159000

|

HAG

|

67000- (ann increment @ 3%) -79000

|

Nil

|

201000

|

|||

HAG+ Scale

|

75500- (ann increment @ 3%) -80000

|

Nil

|

226500

|

|||

Apex Scale

|

80000 (Fixed)

|

Nil

|

240000

|

|||

Cab. Sec.

|

90000 (Fixed)

|

Nil

|

270000

|

|||

DOWNLOAD pdf file format : Projected-Pay-scale-after-7th-Pay-Commission

Tuesday 8 October 2013

Govt working on mobile app to allow users to apply, pay fees for passports

Govt working on mobile app to allow users to apply, pay fees for passports

Ministry of

External Affairs will soon be launching an upgraded version of its

mPassport Seva app to allow users to apply for passports as well as pay

the pay the passport application fee via their smartphones.

The government had launched the mPassport Seva

app earlier this year. The app will let users log in, file the

application and track their application status through their

smartphones.

The mPassport Seva can be downloaded

free from www.passportindia.gov.in. The app allows users to track their

application status, view the complete tracking process, get complete

information about the nearest Passport Seva Kendra (PSK) as well as get

general information regarding the procedure for passport application.

Golok Kumar Simli, principal consultant

and head (technology), ministry of external affairs stated, "The

facility to help applicants fill passports and make payment through the

app should be available in one to one-and-a-half months". He added that

users will still have to carry hard copies of the documents required to

the passport seva kendra after an ARN number is generated and an

appointment is fixed. Simli said that the app was being developed by

Tata Consultancy Services and will be handed over to MEA later.

The app will let users apply for

passports via their Android mobile phones. Users will also be able to

make passport application fees online via their credit or debit cards.

The applicant can then visit the nearest PSK and collect their allotted

'application reference number'. The number of passports issued this year

has increased to 85 lakh this year as compared to 74 lakh passports

issued last year, an official added.

Source: ET

Top 10 Tablets

Excellent

Retina display, extreme performance & robust app ecosystem makes the latest iPad the best tablet today

/

Good

Good

Weatherproof, gorgeous, powerful and some India specific apps this the ideal premium Android tablet.

2 Sony Xperia Tablet Z

Good

Good

Weatherproof, gorgeous, powerful and some India specific apps this the ideal premium Android tablet.

3 Google Nexus 7 2nd Gen (2013)

06-08-2013

Team Digit

Not available officially but the 2nd gen Nexus 7 is the best tablet for pure Android experience.

4 Apple iPad mini

Extremely portable yet enough resolution and screen estate for comfortable viewing experience.

/

Good

Compact size, along with S Pen and multi-window capabilities make it the ideal multitasking tablet.

Good

Compact size, along with S Pen and multi-window capabilities make it the ideal multitasking tablet.

5 Samsung Galaxy Note 510

Good

Good

6 Google Nexus 7

Good

Good

7

Samsung Galaxy Note 800 Good

Good

This Android tablet brings the S-Pen on a 10-inch display, and can also make calls.

Subscribe to:

Posts (Atom)